CEO of Credit Repair Company Welcomes ASIC Review into the Credit Repair and Debt Management Sector

This article has been contributed by Victoria Coster, CEO, Credit Fix Solutions

ASIC has announced a probe into credit repair and debt management services, which has been welcomed by Victoria Coster, CEO of Credit Fix Solutions.

“Having seen firsthand the damage caused by predatory operators over 14 years, I applaud ASIC’s willingness to shine a spotlight on conduct that must change. Consumers deserve a safe place to land.” – Victoria Coster, CEO, Credit Fix Solutions

Founded in 2014 as Australia’s first-ever deferred fee credit repair firm, Credit Fix Solutions warmly welcomed the 22 July 2025 announcement by the Australian Securities and Investments Commission (ASIC) that it would conduct a comprehensive review of all licensed credit repair and debt management firms.

With 25 years of hands-on experience in the credit repair, debt management and finance industries, CEO Victoria Coster has built the company’s reputation on rigorous compliance, ethical transparency, and client-first outcomes.

ASIC’s Industry Review: Timely and Essential

ASIC’s launch of surveillance of around 100 credit licensees, focusing on compliance, fee structures, communication, and promised deliverables, is considered both timely and essential.

Commissioner Alan Kirkland highlighted several disturbing real-life cases: a consumer left in the dark while default notices escalated; another encouraged toward bankruptcy despite unanswered inquiries; and firms insisting on strict no-refund policies despite service failure (9News- Financial watchdog ASIC launches crackdown on dodgy debt managers).

According to CEO Coster:

“At Credit Fix Solutions, we receive at least one call per week from individuals seeking redress after being left worse off by unscrupulous providers, charged high fees, poor communication, or outright misleading claims.”

As ASIC has identified, the sector includes operators who charge significant fees for limited or no services, fail to meet agreement terms, and block refunds – leaving vulnerable consumers seriously harmed (Mirage News).

A Business Built on Ethics and Transparency

ASIC’s 2025 enforcement priorities align squarely with the values of Credit Fix Solutions. Even prior to the 2021 licensing, the company voluntarily self-regulated its service offerings to be an honest and fair credit repair firm.

As a boutique business, Credit Fix Solutions mainly assists finance brokers with credit reporting education and credit repair services where needed, and only if it benefits their clients. For context, out of 20 reports seen daily, the company only onboards around 2 to 3 clients.

The remainder of the week is spent educating consumers on credit reporting and providing DIY options at the company’s own cost. Credit Fix Solutions believes consumers deserve a safe place to land when it comes to credit reporting education and honest solutions.

A Vision for Lasting Impact

The vision for Credit Fix Solutions is to be a long-standing firm providing education, DIY options, and only credit repair where needed.

CEO Victoria Coster recently shared a financial literacy course with The Anglican Schools Corporation, developed alongside Beth Comino, CEO of HAS (Home Affordability Solutions). They hope the course will be rolled out to schools everywhere.

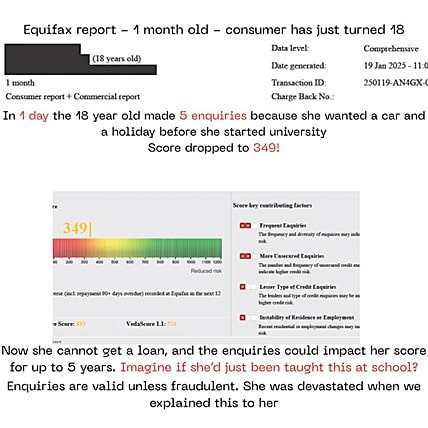

Multiple times daily, when assessing a report, the company finds that consumers have data that – with some education – could have been prevented from appearing.

The long-term vision includes ensuring the next generation leaves school with a clear understanding of how to start their wealth creation journey on the right foot, particularly in regional and low socio-economic areas.

Supporting Reform That Matters

Credit Fix Solutions supports ASIC’s plan to publish its findings in mid-2026 and expects the review will bring lasting improvements in consumer confidence and industry standards. For regulated businesses like Credit Fix Solutions, greater scrutiny confirms that ethical, effectiveness-based models are both sustainable and essential.

A Message from the CEO

“Having seen firsthand the damage caused by predatory operators over 14 years, I applaud ASIC’s willingness to shine a spotlight on conduct that must change. Consumers in financial distress deserve honesty, fairness and professionalism, not high upfront charges and empty promises.

At Credit Fix Solutions, we’ve been pioneering deferred fee credit repair in Australia since 2014 and continue to set the standard for integrity, transparency and real outcomes.”

“Having a consumer call in at least once a week, stating they’d been paying a credit repair firm for months and nothing had happened, or they had paid an upfront fee and not all negative data had been cleared so they still couldn’t obtain finance is simply heartbreaking.”

Credit Fix Solutions believes that although more legislation might not help – because dodgy operators are getting around the rules now and will likely get around new rules too – a review is very much needed to prevent these egregious harms from hard-working Aussie battlers being sold a fake dream and paying for it.

With ASIC’s review now under way, Credit Fix Solutions calls on all stakeholders to back this initiative and help transform the credit repair and debt management industry into a truly consumer-focused sector.

The importance of understanding what enquiries do to your credit report and credit score. Be proactive, not reactive!

Responses